3 Tips from Someone With Experience

Navigating the Complexities of Bankruptcy in Salinas, CA: A Guide for Individuals and Businesses

Navigating the Complexities of Bankruptcy in Salinas, CA: A Guide for Individuals and Businesses

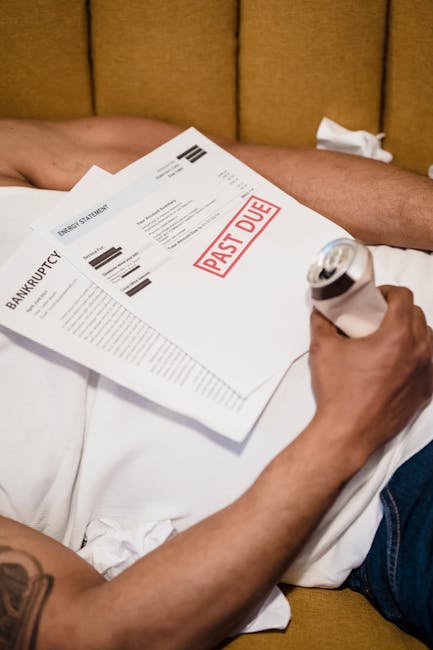

Bankruptcy can be a complex and intimidating process, especially for individuals and businesses in Salinas, CA. However, with the right guidance and understanding of the process, it can be a valuable tool for individuals and businesses to overcome financial difficulties and start anew. In this article, we will explore the basics of bankruptcy, the different types of bankruptcy, and the benefits and drawbacks of filing for bankruptcy in Salinas, CA.

What is Bankruptcy?

Bankruptcy is a legal process that allows individuals and businesses to restructure their debts and start fresh. When an individual or business files for bankruptcy, they are seeking protection from creditors and the opportunity to reorganize their finances. Bankruptcy can be a powerful tool for individuals and businesses to overcome financial difficulties, such as debt, foreclosure, or business failure.

Types of Bankruptcy

There are several types of bankruptcy, each with its own unique characteristics and benefits. The most common types of bankruptcy are:

1. Chapter 7 Bankruptcy: Also known as a liquidation bankruptcy, Chapter 7 bankruptcy involves the sale of assets to pay off debts. This type of bankruptcy is often used by individuals who have a large amount of debt and few assets.

2. Chapter 11 Bankruptcy: Also known as a reorganization bankruptcy, Chapter 11 bankruptcy allows businesses to restructure their debts and continue operating. This type of bankruptcy is often used by businesses that are struggling financially but want to continue operating.

3. Chapter 13 Bankruptcy: Also known as a wage earner’s plan, Chapter 13 bankruptcy is a repayment plan that allows individuals to pay off debts over time. This type of bankruptcy is often used by individuals who have a steady income and want to pay off debts over time.

Benefits of Bankruptcy

Bankruptcy can provide numerous benefits for individuals and businesses, including:

1. Protection from Creditors: Bankruptcy provides protection from creditors, allowing individuals and businesses to avoid harassment and collection efforts.

2. Debt Relief: Bankruptcy can provide relief from debt, allowing individuals and businesses to eliminate or restructure debts.

3. Fresh Start: Bankruptcy can provide a fresh start for individuals and businesses, allowing them to start anew and rebuild their financial lives.

Drawbacks of Bankruptcy

While bankruptcy can provide numerous benefits, it also has some drawbacks, including:

1. Credit Score Impact: Bankruptcy can negatively impact credit scores, making it more difficult to obtain credit in the future.

2. Public Record: Bankruptcy is a public record, which can be embarrassing for some individuals.

3. Limited Options: Bankruptcy may not be an option for everyone, as it is subject to certain eligibility requirements.

Filing for Bankruptcy in Salinas, CA

If you are considering filing for bankruptcy in Salinas, CA, it is essential to understand the process and requirements. Here are some steps to follow:

1. Determine Eligibility: Determine whether you are eligible for bankruptcy by reviewing the eligibility requirements.

2. Choose a Bankruptcy Attorney: Choose a reputable bankruptcy attorney who has experience in bankruptcy law.

3. Gather Documents: Gather all necessary documents, including financial statements, tax returns, and identification.

4. File for Bankruptcy: File for bankruptcy with the court, providing all required documents and information.

5. Attend Creditors’ Meeting: Attend a creditors’ meeting, where creditors can ask questions and object to the bankruptcy filing.

Conclusion

Bankruptcy can be a complex and intimidating process, but with the right guidance and understanding, it can be a valuable tool for individuals and businesses to overcome financial difficulties and start anew. By understanding the basics of bankruptcy, the different types of bankruptcy, and the benefits and drawbacks of filing for bankruptcy, individuals and businesses can make informed decisions about their financial futures. If you are considering filing for bankruptcy in Salinas, CA, it is essential to consult with a reputable bankruptcy attorney who can guide you through the process and help you achieve a fresh start.

If You Think You Understand , Then Read This

This post topic: Internet Services